Construction equipment depreciation calculator

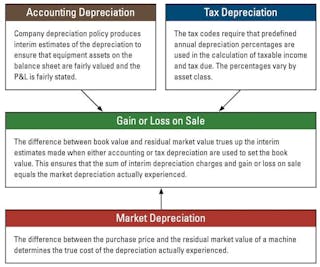

Lets turn to the diagram and develop a simple pragmatic understanding of a how depreciation works. Multiply the total cost of a piece of equipment x 5month x 13 x 80 to arrive at the estimated annual rental dollars.

Three Types Of Asset Depreciation Construction Equipment

We do work we put completed.

. We then need to subtract the original cost of the equipment 103000 from that number to find our net profit over 5 years. There are many variables which can affect an items life expectancy that should be taken into. C Initial cost of machine S Scrap value N Number of years of life of machine D Depreciation amount.

Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules. The Internal Charge Rate Calculator lists hourly ownership and operating costs for construction equipment fixed and variable costs are presented in this product. Facility equipment wont last forever so its important for facility managers to determine the average number of years an asset will be useful before its value is fully depreciated.

Depreciation expenses represent a significant part of total expenses of construction machinery. Precise calculation of depreciation expenses is often difficult or impossible. Also includes a specialized real estate property calculator.

We understand the importance of accuracy and timeliness with your business and tax needs and we make certain that you can rely on us to get the job done. This money either be borrowed from a lender or it will be taken. The depreciation in a given year can be expressed by the following equation.

Following is an example. Box 1 shows the beginning of the cycle. 391126 103000 288126 Given a 60.

Straight Line Asset Depreciation Calculator Enter the purchase price of a business asset the likely sales price and how long you will use the asset to compute the annual rate of. The Hourly Depreciation is the depreciation cost in respect of new machines chargeable to the work on hourly basis is calculated using Hourly depreciation 09 Book Value Life SpanTo. Up to 24 cash back The purchase of construction equipment requires a significant investment of money.

The calculator should be used as a general guide only.

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Of Building Definition Examples How To Calculate

Depreciation Calculator Definition Formula

Declining Balance Depreciation Calculator

Units Of Production Depreciation Calculator Efinancemanagement

Depreciation Of Building Definition Examples How To Calculate

Cost Of Construction Equipment How Do You Calculate Construction Equipment Costs Lceted Lceted Institute For Civil Engineers

How Is The Depreciation Of Construction Equipment Calculated Worldwide Construction Equipment

Depreciation Formula Calculate Depreciation Expense

Purchasing Construction Equipment Calculating The Return On Investment

Depreciation Of Building Definition Examples How To Calculate

Pdf Methods Of Calculating Depreciation Expenses Of Construction Machinery

Macrs Depreciation Calculator Based On Irs Publication 946

Depreciation Formula Calculate Depreciation Expense